Find Your WHY 2 Easy Ways to Discover Your Life’s Purpose

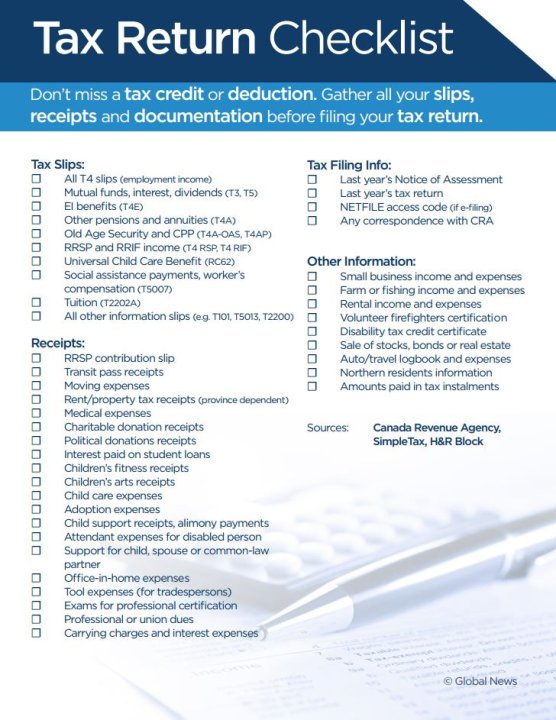

Filing your tax return? Don’t these credits, deductions

2024 federal income tax rates. These rates apply to your taxable income. Your taxable income is your income after various deductions, credits, and exemptions have been applied. There are also various tax credits, deductions and benefits available to you to reduce your total tax payable. See how amounts are adjusted for inflation.

Limit For Maximum Social Security Tax 2020 Financial Samurai

2023 Income Tax Calculator. unsubscribe@hrblock.ca. At H&R Block, our Tax Experts make taxes simple. File your tax return the way you want and we'll get you your max refund. File in-office, online, or drop….

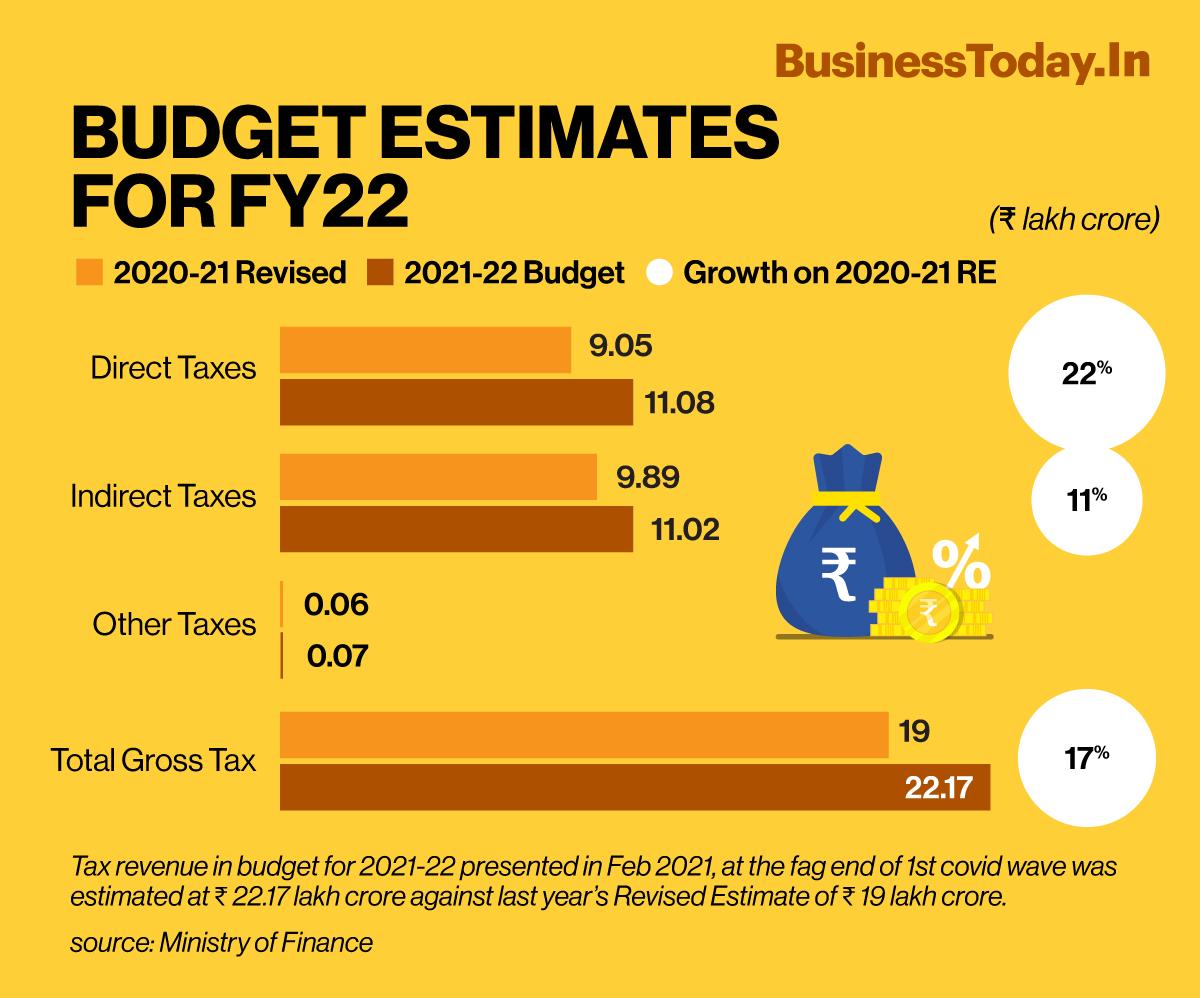

Direct tax collection in FY22 grew 49, indirect tax collection 30

If you earned an extra $1,000, you will have to pay an additional 31.48% of that amount in tax, or $314.80. Free income tax calculator to estimate quickly your 2023 and 2024 income taxes for all Canadian provinces. Find out your tax brackets and how much Federal and Provincial taxes you will pay.

Can You Use the 30 Federal Tax Credit for Solar? The Energy Miser

How you file your return can affect when you get your refund. The CRA's goal is to send you a notice of assessment, as well as any refund, within the following timelines: online - 2 weeks. paper return - 8 weeks. non-resident returns - 16 weeks. These timelines apply only to returns that are received on or before the due date.

Filing your Tax Return in Canada Students Get 6000 Refund All

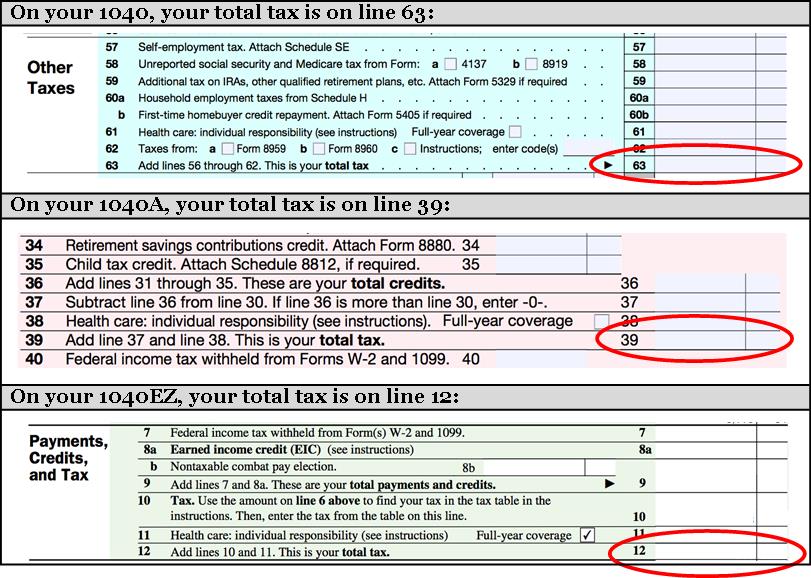

From that point, the equation is: Step 1: total income - total deductions = taxable income. Step 2: taxable income x average tax rate = tax on taxable income. Step 3: tax on taxable income - (sum of all credits x 0.15) = tax payable. Step 4: tax payable - tax already paid + other refundable credits = refund.

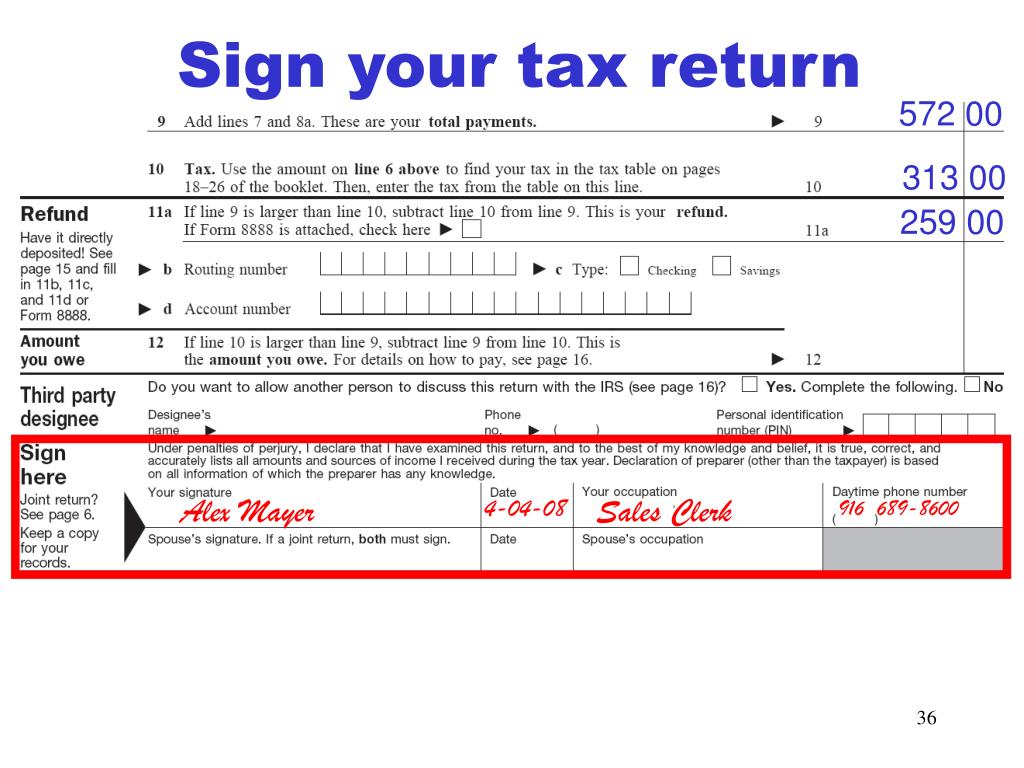

PPT How to fill out a Tax Return PowerPoint Presentation, free

Example: $40,000 (total income) - $5,000 (RRSP contributions) = $35,000 (taxable income) Calculate your total tax payable. Apply the appropriate federal and provincial tax rates to your taxable income, to determine your total tax payable. Example: For a taxable income of $35,000: Federal tax: $35,000 x 15% = $5,250.

TAX RETURN text — Stock Photo © belchonock 148524647

There are exercises available to test yourself on completing a basic tax return. Go to: Calculate a refund or a balance owing. Next: After sending us your tax return. Date modified: 2022-10-07. An introduction into filling out a Canadian income tax and benefit return which includes information on reporting income, claiming deductions and non.

Tax Return 2022 Direct Deposit Dates Latest News Update

How To Establish Your Total Income. To calculate your refund, add up your income from all sources to get your total income. This amount will be shown on Line 15000 - Total Income. Some examples of income and the slips they are reported on are: Employment - T4 Statement of Remuneration Paid.

CI Post 2…Do Immigrants Pay Taxes?

Plug in a few numbers and we'll give you visibility into your tax bracket, marginal tax rate, average tax rate, and payroll tax deductions, along with an estimate of your tax refunds and taxes owed in 2023. File your tax return today. Your maximum refund is guaranteed. Get started.

Live in N.J.? You’ll pay more in taxes over a lifetime than anywhere

The training limit for most Canadians who are eligible for this credit is now $1,000 for 2023 which is up from its previous limit of $750 in 2022. You can find your Canada training limit on your 2022 Notice of Assessment. The Canada training credit is refundable, which means if your credit is higher than the amount of tax you owe, you get to.

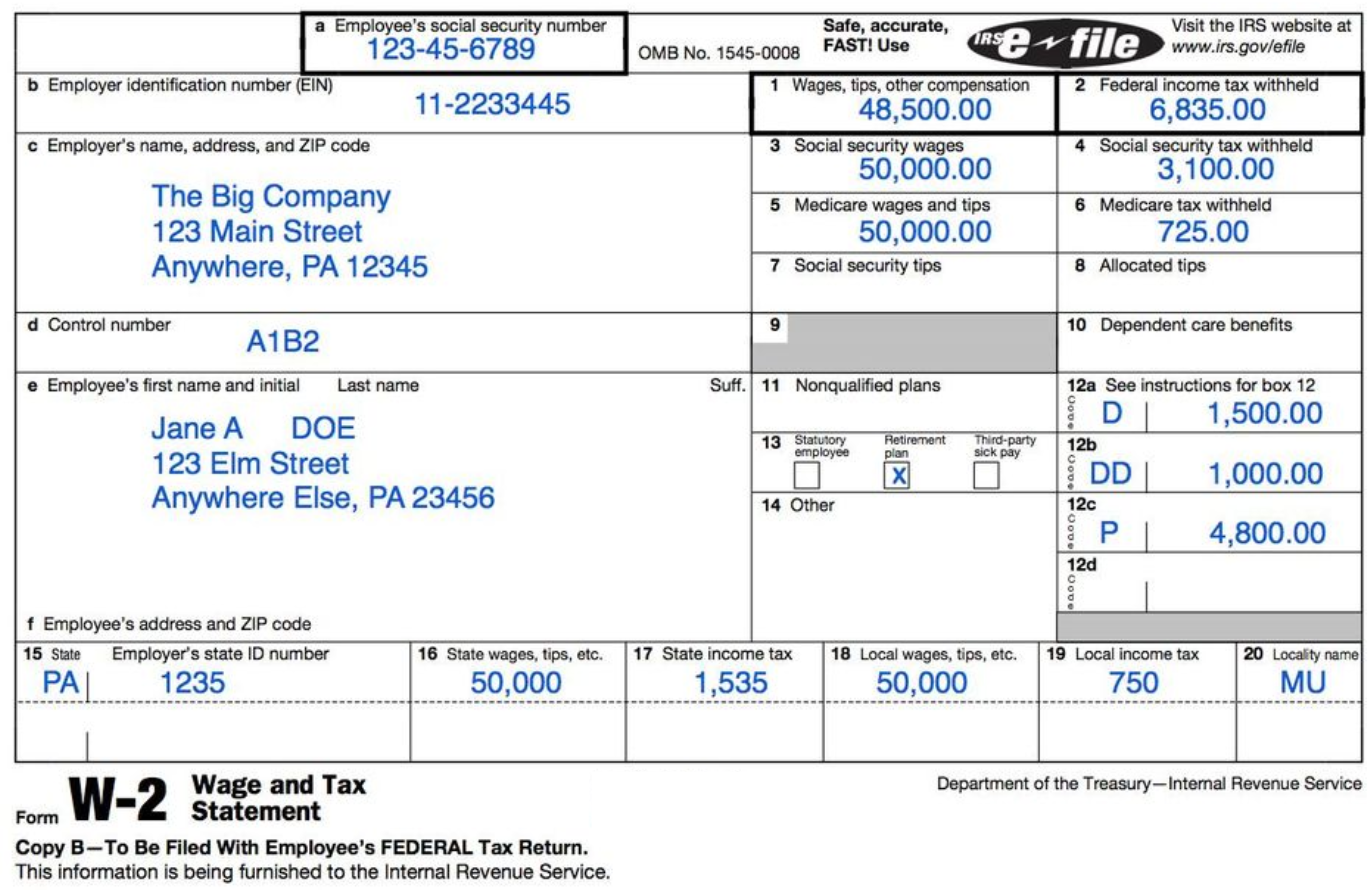

Understanding Your Forms W2, Wage & Tax Statement Tax, Tax refund

To complete your personal income tax return, the CRA requires certain personal information including your full legal name, address and social insurance number (SIN). You will also need to provide proof of all the income you earned during the tax year you're filing for. So, for example, for the 2023 tax year, you'll need to provide the CRA.

File Tax Return Stock Photography Image 23086762

You can expect your return within two weeks and eight weeks when you file a paper return, as long as you file on time, according to the government. Non-residents, though, can expect a longer wait.

WHAT WILL YOU USE YOUR TAX RETURN FOR? PRONTO Blog

For the 2023 tax year, prior to filing your tax return electronically with NETFILE, you will be asked to enter an Access code after your name, date of birth, and social insurance number. Your eight-character Access code is made up of numbers and letters and is located on the right side of your Notice of Assessment for the previous tax year.

How Federal Tax Rates Work Urban Institute

If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software. TurboTax Free customers are entitled to a payment of $9.99. Claims must be submitted within sixty (60) days of your TurboTax filing date, no later than May 31, 2024 (TurboTax Home & Business and TurboTax 20 Returns no later than July 15, 2024).

Find Your WHY 2 Easy Ways to Discover Your Life’s Purpose

Filing a paper tax return. To get a tax return form, you can either: download one from the Canada Revenue Agency website; view and order forms at canada.ca/taxes-general-package; call the CRA at 1-855-330-3305 to order a copy; To access tax credits and benefits when filing a paper tax return, complete and submit these three forms with your tax.

tax return and tax investigators Stock Photo Alamy

Use our simple 2023 income tax calculator for an idea of what your return will look like this year. Get a rough estimate of how much you'll get back or what you'll owe. Province Select Province* Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Québec Saskatchewan Yukon

.